Latest Update: Nov 14, 2025, 7:48:48 AM

In recent years, due to the decrease in rainfall, establishing and operating greenhouses has become a necessity. This approach generates income and ensures good productivity for farmers. However, before anything else, applicants must be able to provide capital for constructing the greenhouse structure. For this reason, the government has offered facilities such as greenhouse construction loans in various packages to support farmers so that eligible individuals can utilize these opportunities to expand their business.

Types of Greenhouse Construction Loans

Currently, greenhouse construction loans are available to applicants in various forms, including:

Agricultural Jihad Loan

One of the government’s policies to address the drought crisis is granting greenhouse construction loans through the Agricultural Jihad organization. The government aims to promote greenhouse cultivation by providing these financial facilities.

Rural Loan

Another permit for establishing greenhouses is for rural areas. Farmers in villages with infrastructure such as gas, electricity, and water can obtain permits to build greenhouses up to 300 square meters. These loans are provided with 4–6% interest rates and a repayment period of 6 to 12 months. If you plan to set up a greenhouse and need more comprehensive information about obtaining a construction permit, you can read the article on greenhouse construction permits.

Agricultural Bank Loan

Another type of greenhouse construction loan is offered by the Agricultural Bank to applicants. These loans are low-interest due to their supportive nature, and repayment terms range from 1 to 3 years.

Small-Scale Greenhouse Loan

Establishing and operating small-scale greenhouses, typically on lands of 1,000 square meters, is economically justified. Therefore, the government has provided interest-free rural facilities for these greenhouses. The permit for this small-scale greenhouse loan must be issued with a letter from the Imam Khomeini Relief Committee. These facilities have no restrictions and cover all employment and development projects. For more details, you can visit our About Us page.

Conditions for Obtaining a Greenhouse Construction Loan

To obtain a greenhouse construction loan, you must first meet the necessary conditions, one of the most important being providing collateral for the bank. After review by the bank, a guarantor is also required for the loan to be approved. It should be noted that different banks have varying requirements for granting greenhouse construction loans. For example, some banks only provide loans to applicants with land over 2,000 square meters, while others may approve loans for lands under 1,000 square meters.

The applicant must also meet personal eligibility criteria, such as being of legal age and holding at least a high school diploma. If you meet all the requirements, you should bring your documents and application to a branch of the Agricultural Bank in your city and submit your request.

Required Documents for Greenhouse Construction Loan

Applicants must collect and provide the following documents to the bank:

-

Farmer identification documents, including national ID and birth certificate

-

Collateral documents

-

Greenhouse construction site documents

-

Permits obtained from legal authorities

Steps to Obtain a Bank Loan for Greenhouse Construction

-

First, visit the Agricultural Jihad management office in your area and submit a request letter for greenhouse construction along with a detailed description of your plan.

-

Register in the Jihad Agricultural SITA system at cita.maj.ir and receive a tracking code.

-

Revisit the Agricultural Jihad office to have your greenhouse project reviewed by their experts.

-

The project is then referred to the provincial executive department, and approval is processed in the system by the county.

-

The plan is reviewed by the Planning and Economic Affairs Deputy, then forwarded to the Investment Management Department.

-

All aspects of the greenhouse construction plan are analyzed by the investment expert.

-

The plan is reviewed again by the management team of experts, then assessed by the Economic and Investment Development Task Force.

-

The project is introduced to the bank.

-

As an applicant, you must visit the bank to open a loan file.

-

Finally, the greenhouse construction plan is reviewed by the bank, and if all aspects are approved, the loan is provided.

Hydroponic Greenhouse Loan Facilities

In hydroponic greenhouses, crops are grown without soil, which requires significantly higher costs. For hydroponic greenhouses, low-interest loans of around 7% are offered with a 2-year grace period. The repayment term for hydroponic greenhouse loans is 5 years, and farmers benefit from minimal energy costs for greenhouse operations. For more information, you can visit our About Us page.

Gol Afrouz Greenhouse Construction Company, with years of outstanding experience, is a leading manufacturer in the field of modern greenhouses, ready to serve clients across Iran. Leveraging up-to-date knowledge and a specialized team, we design and construct various types of Iranian, Spanish, Dutch, and tunnel-style greenhouses with the highest quality, tailored to your needs.

Additionally, Gol Afrouz provides all efficient and modern greenhouse equipment. If you are in Karaj, Tehran, or any other city in Iran and are looking for a reliable partner to establish your greenhouse, visit our website today to contact us and benefit from expert consultation from our specialists.

Complete Guide to Tomato Greenhouse Construction: Soil vs. Hydroponic

Complete Guide to Tomato Greenhouse Construction: Soil vs. Hydroponic

How to Build a Cucumber Greenhouse

How to Build a Cucumber Greenhouse

How to Build a Home Greenhouse from A to Z

How to Build a Home Greenhouse from A to Z

Cost of Building a 1,000 sqm Hydroponic Greenhouse

Cost of Building a 1,000 sqm Hydroponic Greenhouse

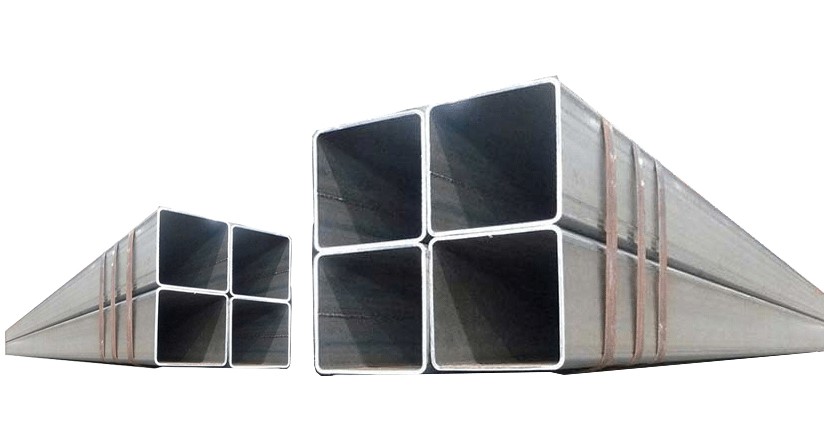

Galvanized can profile 10

Galvanized can profile 10

Axial Fan Evaporative Cooler

Axial Fan Evaporative Cooler

Furnace Heater

Furnace Heater

Type 4 Circulation Fan

Type 4 Circulation Fan

Greenhouse Mist Sprayer

Greenhouse Mist Sprayer